Canadian Government Funding for Small Business Owners

As a small business owner in Canada, new or existing – or planning a startup, one of the main things on your mind is money.

Do you have enough money? How do you get more money? What will happen if you run out of money?

So what is the answer to every entrepreneurs problem?

Canadian Government Funding?

Since every business owner is looking for that extra $5,000, $25,000 or $50,000 in funding to help them startup, expand, hire and train staff, purchase land or equipment, conduct market research, pay for marketing and advertising what better way to achieve your funding goals then to contact the Canadian government for funding for your small business.

Since every business owner is looking for that extra $5,000, $25,000 or $50,000 in funding to help them startup, expand, hire and train staff, purchase land or equipment, conduct market research, pay for marketing and advertising what better way to achieve your funding goals then to contact the Canadian government for funding for your small business.

Funding from the Canadian government is a great option, and one alternative to personal lines of credit, credit cards and bank loans that most people think of when considering starting their small business.

The fact is, thousands of entrepreneurs across Canada are successful at obtaining government funding in the form of government grants, government loans, tax breaks and financial assistance.

So what is the problem? What are you waiting for?

The Problem…

As much as Canadian government funding is the perfect solution for any business (new or existing), it is not very easy to obtain.

The Canadian government does not intentionally hide the information, but they don’t make the “funding program information” easily accessible. While not a fault of their own, but the Canadian government has hundreds of funding programs which are offered by different levels of the government (some that don’t even talk to other levels of government). With so many funding agencies, providing government funding for different funding purposes, in different locations and for different funding needs – it is very difficult to provide all the funding information in one place for the every day entrepreneur.

Not to mention that you probably wouldn’t want to be reading hundreds of pages of content on the government funding agency website to figure out whether you may or may not be eligible to apply tot hat specific program.

So what is the option…

Starting a business is not difficult if you have the startup tools you need such as a Startup Guide, Business Plan Builder Tool, a Funding Database and guidance along the way. The difficult part of starting a business is being motivated to do so and not being afraid to invest your time, invest your money and really invest yourself.

When it comes to Canadian government funding, it is not any different.

If you want to find government funding programs that may be right for you, you will have to do research and spend time figuring out what is right for your business.

The things to keep in mind when searching for government funding programs include:

– Knowing where to look for funding programs

– Knowing which funding program is providing funding in your location (city or province)

– Knowing which funding program is providing funding for your industry

– Knowing which funding program is providing funding for your financial needs (Startup Costs, R&D, Hire Staff, Training, Purchase Land, Equipment, Marketing/Advertising…etc)

– Knowing how much funding you really need

– Knowing the eligibility criteria for each program

Wow, that seems like a lot of work and a lot of research.

Most people say government funding information is free and can be found anywhere. If you have a moment right now, I would suggest you do a quick search for a Business Funding to see which source has government programs listed. Let’s see if the government comes up with a list of all programs, or just a few, or none at all.

As you may be aware of, as of today there are 264 government grant programs available. There are also 147 government loan programs and 231 other financial assistance programs available by the Canadian government. Do you have the time to look through those?

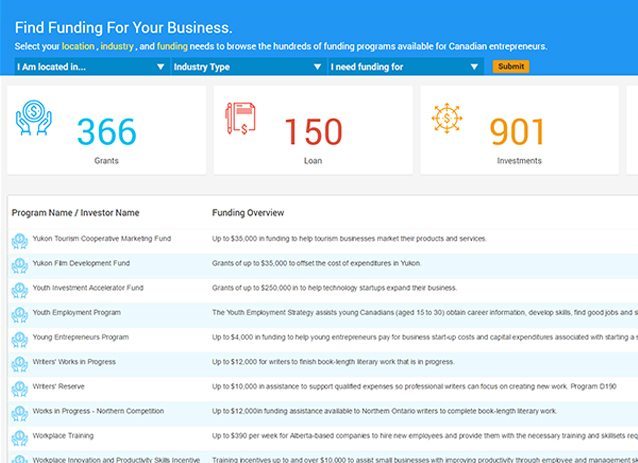

We (CanadaStartups) made it a little easy for you. With our Funding Database, which you can access once you become a registered member, you will get access to all of the available government funding programs which include government grants, loans and tax breaks, and also over 800 private investor programs. Sure this is just another “list” of what’s available and you will have to do a little bit of research, but we actually made it so easy that all you have to do is click on your province, select your industry and select your financial needs and click GO.

Funding programs that fit that search criteria will be displayed along with any private investor that may be interested in help you fund your business. This way, you only search through what may be available for your business and narrow down your time spent so that you can focus on starting your small business and not researching for funding programs.

How do I know if I can get funded?

This is one question that we get asked all the time. It is a little bit confusing to some entrepreneurs who can get funded and who can’t.

It just seems easy, right? As a Canadian, you pay your taxes, which means that if you want to start a small business the government of Canada will provide you funding. Seems simple, but it doesn’t work that way.

Here are a few real life situations of every day entrepreneurs who were looking for government funding. As you read their business ideas, and how much funding they were seeking be your own judge and determine whether “if you were a funding agency”, would you approve the government grant or the loan?

Anonymous Entrepreneur, Nova Scotia

Amount Seeking: $125,000 grant or loan to purchase a food truck and start the first ever dine-in food truck where customer would be able to walk into the truck, place their order and be seated. No Business Plan provided by entrepreneur. Declined Funding

Anonymous Entrepreneur, Ontario

Amount Seeking: $750,000 in funding to purchase physical location for a tanning salon. A startup business with no prior history or business exposure. Wants to purchase verus rent so they can customize the location to their liking.Declined Funding

Anonymous Entrepreneur, BC

Amount Seeking: $12,000 to hire part-time student employee for one year to knock on doors and sell subscription service to online product with no research, no website and no plan.Declined Funding

As you can see, not everyone has the right idea in mind. And not everyone knows where to go and apply for funding. Out of the 3 above mentioned entrepreneurs, only one entrepreneur had a business plan submitted but due to the amount of funding being asked was declined due to the funding agency not “believing in the idea”. That being said, as much as it is important to have a business plan, you must also be able to convince the funding agency, or private investor into liking you, your business and your idea.

Funding is never guaranteed. One way to increase your chances of obtaining government funding, be it a grant or a loan is to conduct research into the appropriate funding agency that provides funding in your industry, for your location and for the financial needs. Be sure to seek funding in the “available funding” range that the program or agency states, and be sure to reach out to past funding recipients to ask them for their tips, tricks and advice dealing with that specific agency or other funding agencies.

Having the proper details could save you a lot of time and energy. You could really consider obtaining your access to our Funding Database as it will give you the best idea of what is currently available by the Canadian government along with potential funding amounts, qualification criteria and direct links to applications. On top of that, you get your access to the private investors who may offer funding for your small business as well.

SEARCHES RELATED TO CANADIAN GOVERNMENT FUNDING

Canadian Government Funding

Government Funding

small business funding

I WANT START A BUSINESS IN...

IS THERE HELP IN MY INDUSTRY?

- Expansion Capital

- Funding For Equipment

- Business Acquisition Funding

- Consulting Services

- Hiring & Training Staff

- Management Support Services

- Manufacturing

- Mining

- Professional and IT Services

- Transportation and Warehousing

- Accommodation and Food Services

- Agriculture

- Construction

- Culture and Recreation

- Finance and Real Estate

- Forestry, Hunting and Fishing

- Health and Social Assistance