6 Small Business Government Funding Program Types in Canada

Category: Infographics

Tags: Canadian Government Funding, funding types, Government Funding

As a small business owner or startup entrepreneur you’ve most likely heard of government funding program types in Canada?

If you haven’t, you are missing out as there could be potential money available to help your small business startup, to expand and to cover the every day expenses of your small business such as:

- Hiring of staff costs

- Training of employees

- Marketing and advertising

- Purchase of tools, supplies and equipment

- Leasehold improvements and renovations

- Improving import and export capabilities

- Adding to cash flow

- ..etc

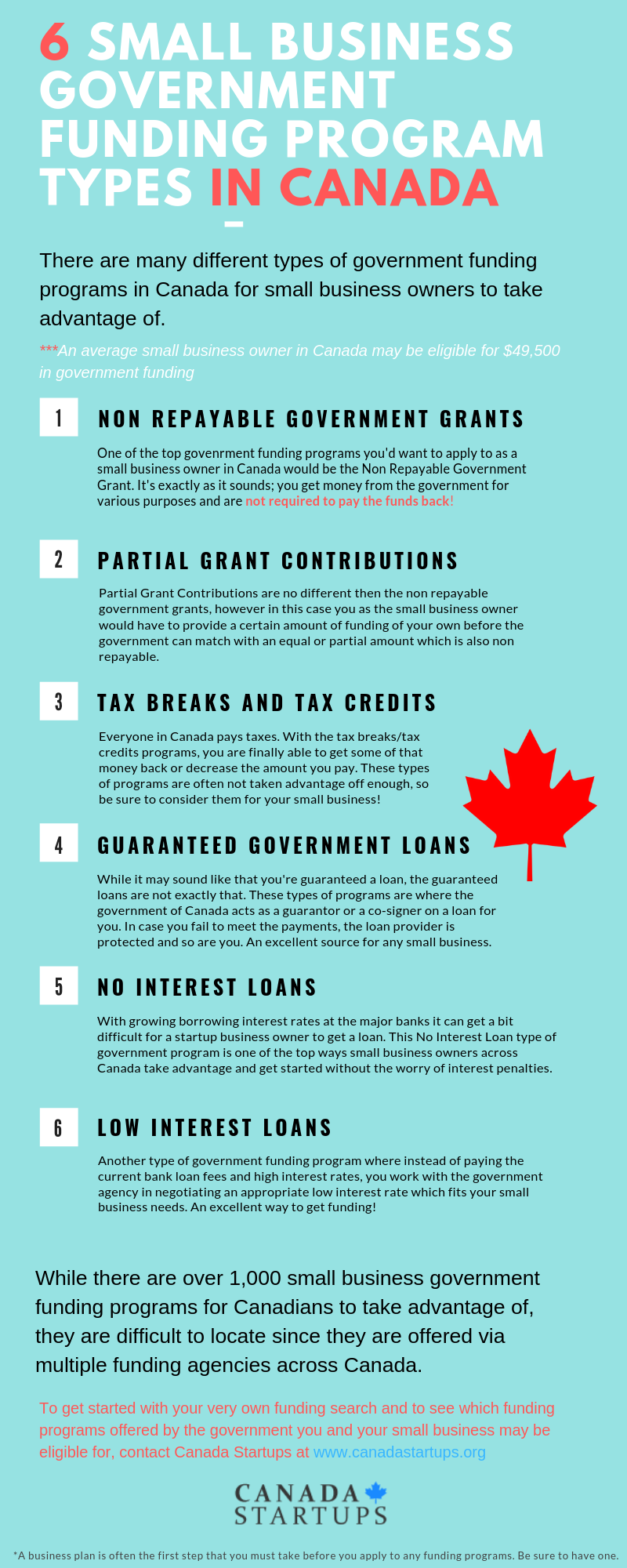

There are many small business government funding program types in Canada for a small business owner to take advantage of.

In fact, on average those individuals who meet the funding program criteria end up obtaining an average of $49,500 in funding.

6 Small Business Government Funding Program Types in Canada Infographic

Here are 6 of the most common small business funding program types offered by the government of Canada.

NON REPAYABLE GOVERNMENT GRANTS

One of the top govenrment funding programs you’d want to apply to as a small business owner in Canada would be the Non Repayable Government Grant. It’s exactly as it sounds; you get money from the government for various purposes and are not required to pay the funds back!

PARTIAL GRANT CONTRIBUTIONS

Partial Grant Contributions are no different then the non repayable government grants, however in this case you as the small business owner would have to provide a certain amount of funding of your own before the government can match with an equal or partial amount which is also non repayable.

TAX BREAKS AND TAX CREDITS

Everyone in Canada pays taxes. With the tax breaks/tax credits programs, you are finally able to get some of that money back or decrease the amount you pay. These types of programs are often not taken advantage off enough, so be sure to consider them for your small business!

GUARANTEED GOVERNMENT LOANS

While it may sound like that you’re guaranteed a loan, the guaranteed loans are not exactly that. These types of programs are where the government of Canada acts as a guarantor or a co-signer on a loan for you. In case you fail to meet the payments, the loan provider is protected and so are you. An excellent source for any small business.

NO INTEREST LOANS

With growing borrowing interest rates at the major banks it can get a bit difficult for a startup business owner to get a loan. This No Interest Loan type of government program is one of the top ways small business owners across Canada take advantage and get started without the worry of interest penalties.

LOW INTEREST LOANS

Another type of government funding program where instead of paying the current bank loan fees and high interest rates, you work with the government agency in negotiating an appropriate low interest rate which fits your small business needs. An excellent way to get funding!

While there are over 1,000 small business government funding programs for Canadians to take advantage of, they are difficult to locate since they are offered via multiple funding agencies across Canada.

To get started with your very own funding search and to see which funding programs offered by the government you and your small business may be eligible for, contact Canada Startups.

SEARCHES RELATED TO CANADIAN GOVERNMENT FUNDING

I WANT START A BUSINESS IN...

IS THERE HELP IN MY INDUSTRY?

- Expansion Capital

- Funding For Equipment

- Business Acquisition Funding

- Consulting Services

- Hiring & Training Staff

- Management Support Services

- Manufacturing

- Mining

- Professional and IT Services

- Transportation and Warehousing

- Accommodation and Food Services

- Agriculture

- Construction

- Culture and Recreation

- Finance and Real Estate

- Forestry, Hunting and Fishing

- Health and Social Assistance